Loan Application Evaluation Scenario

Evaluating loan applications involves a careful analysis of key financial indicators tied to an applicant. Two primary metrics stand out: the applicant's credit score and their debt-to-income ratio. The credit score reflects past financial habits, while the debt-to-income ratio reveals how much of an applicant's income is already committed to existing debts.

Together, these figures give lenders a comprehensive view of an applicant's financial health and ability to repay. By combining this information, financial institutions can make well-informed lending decisions, balancing their own security with the needs of the borrower. The final step is clear communication with the applicant, reinforcing the institution's dedication to clarity and trustworthiness.

What We Will Do:

Collecting Applicant's Information

Capture essential applicant details such as email, phone number, full name, age, location and current job.Validate the provided information for completeness and accuracy to ensure a reliable foundation for the subsequent loan evaluation steps.

Credit Score Verification

Data Gathering: The system will request the applicant's credit score.

Validation Process: Flux will validate if the provided credit score is a numerical value. The accepted range for most credit scores is typically between 300 and 850.

Credit Score Range Status 300 to 579 Poor 580 to 669 Fair 670 to 850 Good

Analyzing Debt-to-Income Ratio

Data Gathering: Monthly Debts (Includes monthly obligations like credit card payments.) and Gross Monthly Income: (Total income before any deductions.)

Calculation Process: The ratio is determined by dividing the total monthly debts by the gross monthly income.

Debt-to-Income Ratio = Total Monthly Debts / Gross Monthly Income.Debt-to-Income Ratio (%) Interpretation 0% to 20% Excellent balance between debt and income. 21% to 35% Good balance but indicates moderate use of income towards debts. 36% to 49% Fair; hints at potential financial strain. 50% and above High; significant part of income goes to debt.

Loan Eligibility Determination

The loan eligibility is primarily ascertained by utilizing two key metrics: the validated credit score of the applicant and the computed debt-to-income ratio. A decision table in Flux will cross-reference the provided metrics with the institution's lending criteria. For instance, applicants with a debt-to-income ratio of more than 0.40 and a credit score below 600 might be flagged as high risk.

| Credit Score Range | Debt-to-Income Ratio Range | Loan Eligibility Result |

|---|---|---|

| 300 to 599 | 0.41 to 0.60 | Denied |

| 600 to 850 | 0.00 to 0.40 | Approved |

Communicating the Decision

Based on the processed data from the previous steps, a final decision regarding the loan application will be made. This ensures immediate feedback, allowing applicants to be informed promptly about the status of their loan request.

Solution

Navigating through a loan application evaluation isn't just about verifying the numbers but also about ensuring that these numbers paint an accurate picture of an applicant's financial situation. Let's set this process in motion:

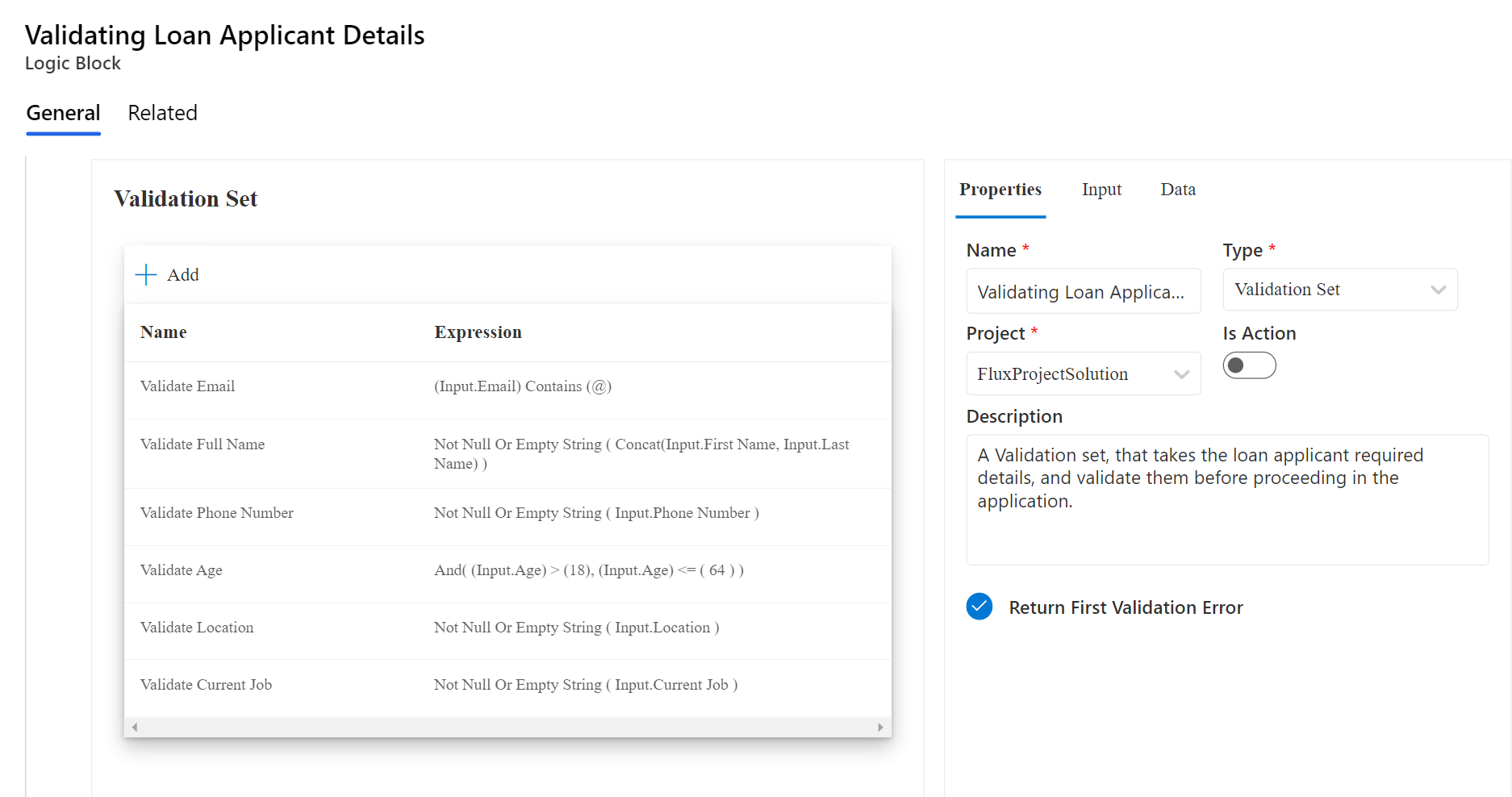

Step 1: Loan Applicant Details Validation Set

To initiate our solution, we will be designing a Validation Set. That accept the loan Applicant's Information as input.

- Phone Number

- Full Name

- Age

- Location

- Current Job

Each of these inputs is equipped with its own validation block to ensure accuracy and correct format, as shown in the picture below.

And the validation set return an error upon encountering the first inconsistency or inaccuracy. This is to ensure immediate feedback for rectification. With our Validation Set in place, it guarantees that all subsequent steps in the evaluation rely on verified and dependable data.

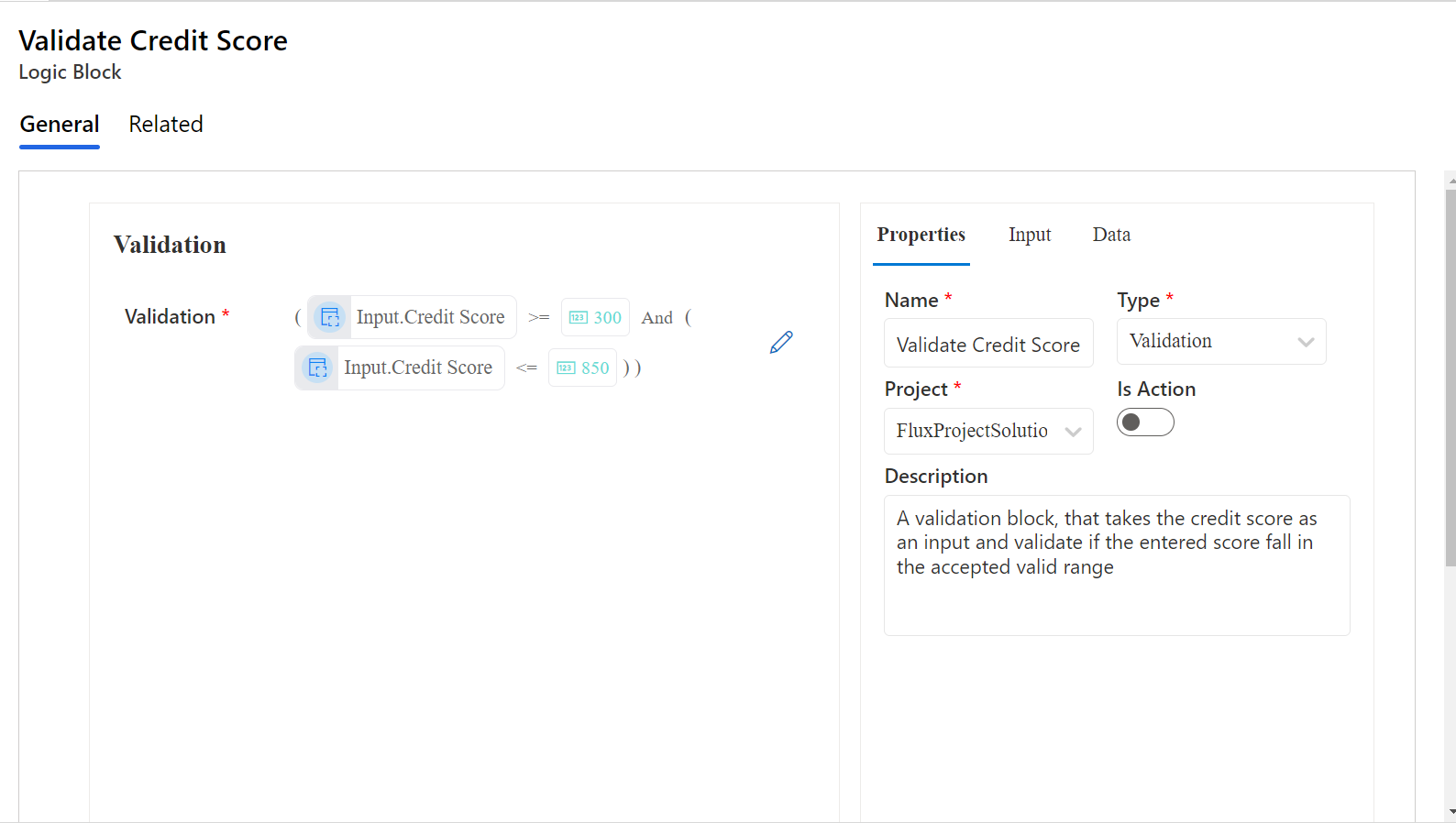

Step 2: Credit Score Validation Block

Every loan application process requires a close examination of the applicant's credit score. It's a crucial metric that offers lenders a snapshot of the applicant's financial trustworthiness. As we embark on this step, it's imperative that the credit score provided is not only genuine but also within the accepted spectrum.

We'll kick things off with a validation block. This block's primary task will be to ascertain if the entered credit score is valid and falls within the range of 300 to 850.

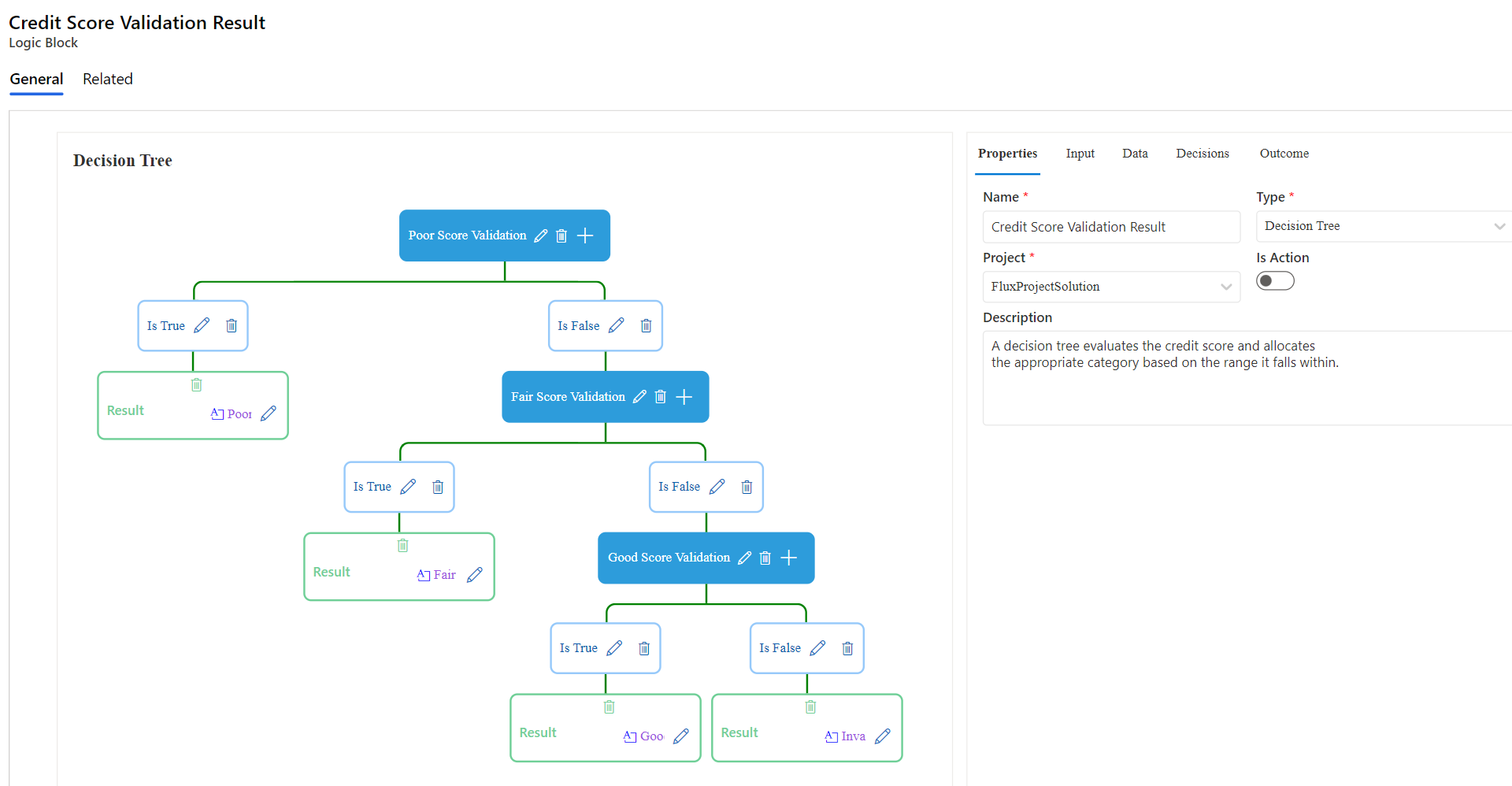

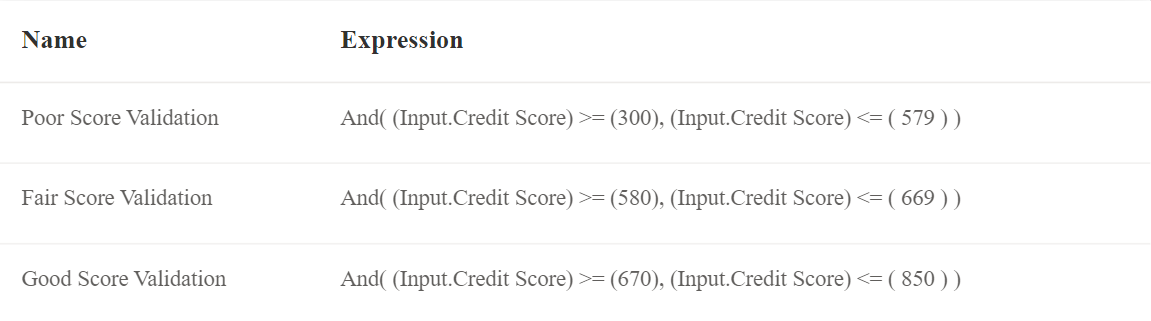

Once we have that confirmation, we can then classify the credit score status - be it poor, fair, or good. This classification forms a foundation for subsequent evaluations in our loan application process.

Using the decision tree provided above and the detailed decisions listed below, we discern three pivotal choices to classify the credit score status. Each of these decisions examines whether the score lies within set boundaries, thus determining if the outcome is poor, fair, or good.

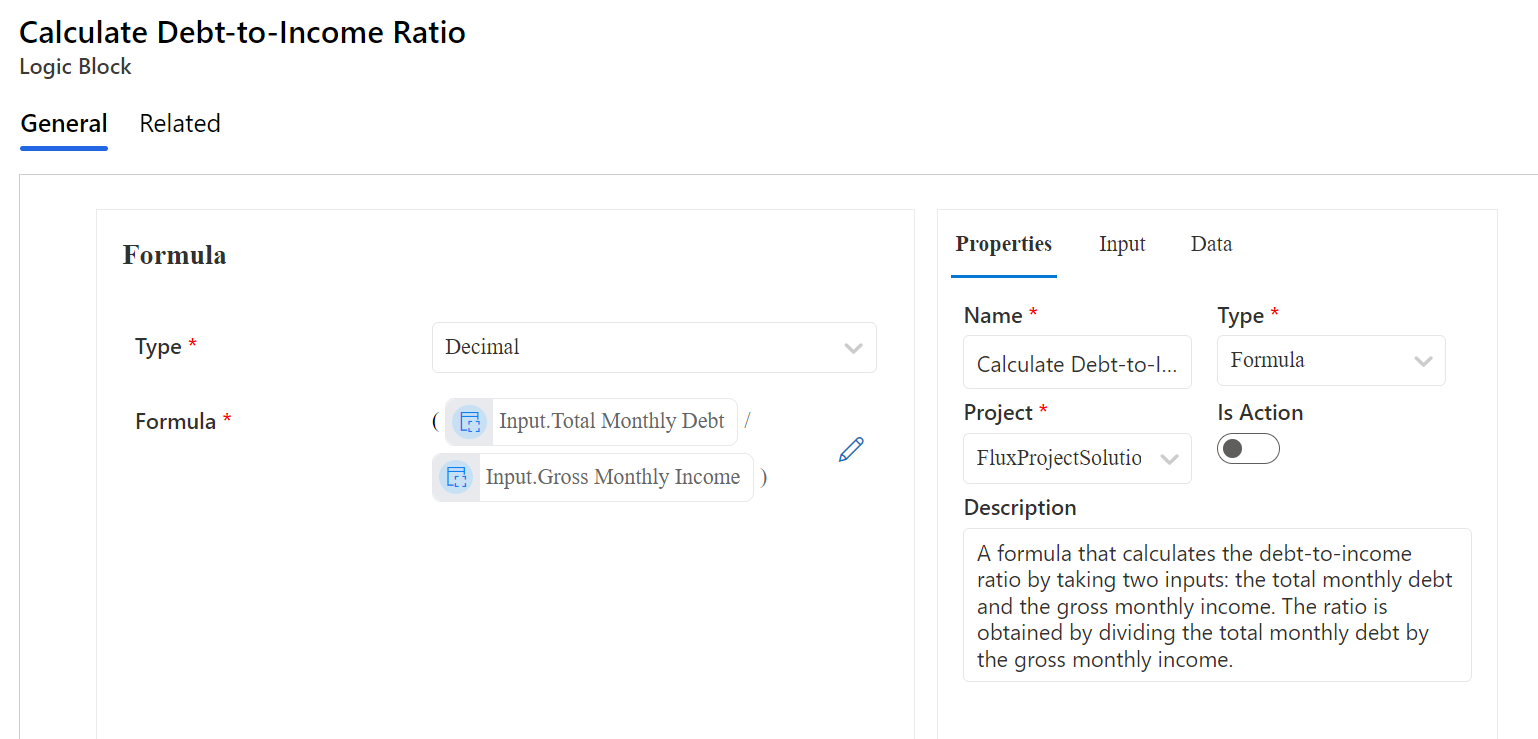

Step 3: Calculating The Debt-to-Income Ratio

To gauge an applicant's financial health, one pivotal metric we assess is the debt-to-income ratio. Using a precise formula, we'll calculate this ratio. We derive it by taking two main inputs: the total monthly debt and the gross monthly income. The final ratio is obtained simply by dividing the total monthly debt by the gross monthly income. This measure provides insights into how much of an individual's income is being used to service their debt, and it's crucial for our loan evaluation process.

With the debt-to-income ratio and credit score in hand, we'll now design the logic to determine the final status of the loan application.

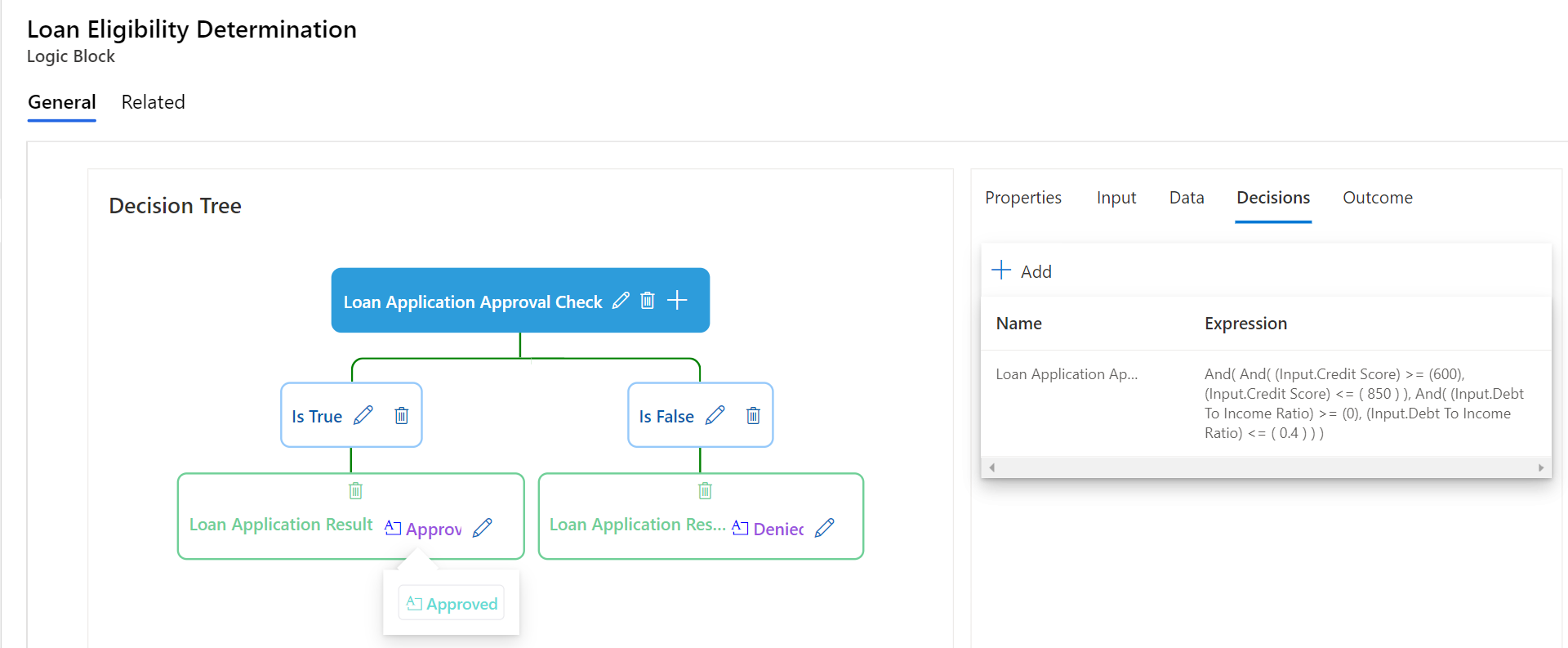

Step 4: Loan Eligibility Decision Tree

Lets build a decision tree that evaluates the applicant's credit score alongside their debt-to-income ratio to make informed decisions. Specifically, a credit score between 300 and 599 coupled with a debt-to-income ratio of 0.41 to 0.60 results in a loan denial. On the other hand, a credit score ranging from 600 to 850 with a debt-to-income ratio between 0.00 and 0.40 leads to an approval. This approach ensures a methodical and data-driven assessment of each loan application.

Having established our logic blocks, we're now ready to integrate them into our Loan Application flow. By embedding each of these blocks within the flow, we ensure a systematic progression that covers every aspect of the loan application process, making it both comprehensive and efficient.

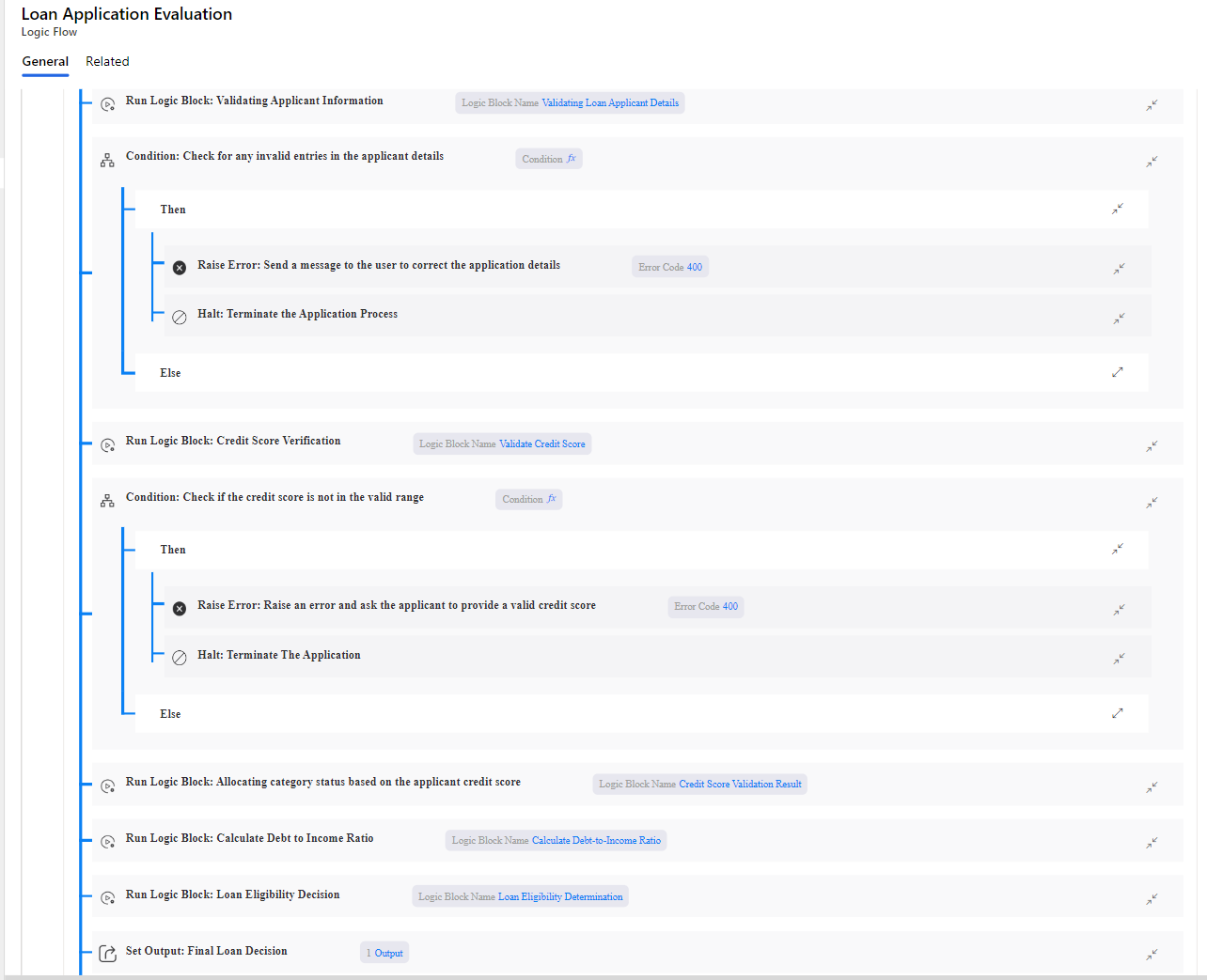

Step 5: Connecting the Dots - Building The Loan Application Evaluation Logic Flow

Flows logic operate as structured sequences, designed to orchestrate a series of tasks or operations in a specific order. At the heart of every flow are its steps. Each step acts as a command, guiding the flow on its subsequent action. Our goal with the loan application evaluation process is to set up a clear sequence of operations, ensuring a systematic assessment of each application.

As we can see in the flow above, we start with:

Data Collection: The process begins by collecting necessary details from the applicant, both personal and financial.

Initial Validation: Using the Validation Set from Step 1, the gathered data is verified for accuracy. If inconsistencies are found, the process is halted for correction.

Credit Score Evaluation: We first evaluate the applicant's credit score as outlined in Step 2. If the credit score isn't within the valid range, the process stops. If valid, we allocate a category status to it.

Debt-to-Income Ratio Evaluation: With the credit score categorized, we then calculate the debt-to-income ratio as described in Step 3.

Eligibility Determination: Based on the categorized credit score and debt-to-income ratio, the Loan Eligibility Decision Tree from Step 4 is employed. This results in a decision of either approval or denial.

Outcome Communication: The applicant is informed of the outcome. If the loan is denied or accepted.

Remember, each stage in this flow is interdependent. The outcome of one step directly informs and influences the next, ensuring that the evaluation is both coherent and comprehensive.

Step-by-Step Video Guide: Navigating the Loan Application Scenario

Welcome to our in-depth video tutorial, designed to guide you seamlessly through the loan application journey. Let's break down each step, ensuring you're well-equipped for success