Car Insurance Premium Evaluation Scenario

Determining car insurance premiums involves analyzing various factors tied to both the vehicle and the driver. A combination of these factors, such as the driver's age, driving record, and the type of vehicle, will significantly influence the final premium. By analyzing this data, insurance companies can determine a fair premium that covers potential risks while providing value to their clients.

What We Will Do:

Collecting Driver and Vehicle Information

Capture essential details about the driver and the vehicle:

- Driver's Details: Name, age, gender, driving experience, driving record (number of accidents or traffic violations in the past 5 years), and location.

- Vehicle Details: Make, model, year, mileage (less then 200), purpose (personal or commercial use), and safety features (anti-lock brakes, airbags, etc.).

Ensure all the provided information is validated for completeness and accuracy.

Age and Driving Record Verification

Data Gathering: Fetch the driver's age and driving record.

Validation Process: Check if the driver's age is a numerical value between 18 and 100. Validate the driving record to be within a range of 0 to 10 incidents in the past 5 years.

Age Group Risk Category Young (18-25) High Risk Adults (26-60) Moderate Risk Seniors (61-100) Low Risk Incidents in 5 Years Risk Category Zone 0 to 2 Low Risk Green 3 to 6 Moderate Risk Yellow 7 to 10 High Risk Red

Vehicle Risk Analysis:

Data Gathering: Collect information about the vehicle's make, model, age, and safety features.

Calculation Process: Older vehicles or those without modern safety features might have a higher risk of injury in an accident, leading to higher medical costs.

Vehicle Age Risk Category Brand New(0 to 5 years) Low Risk Slightly Aged(6 to 10 years) Moderate Risk Aged (11+ years) High Risk

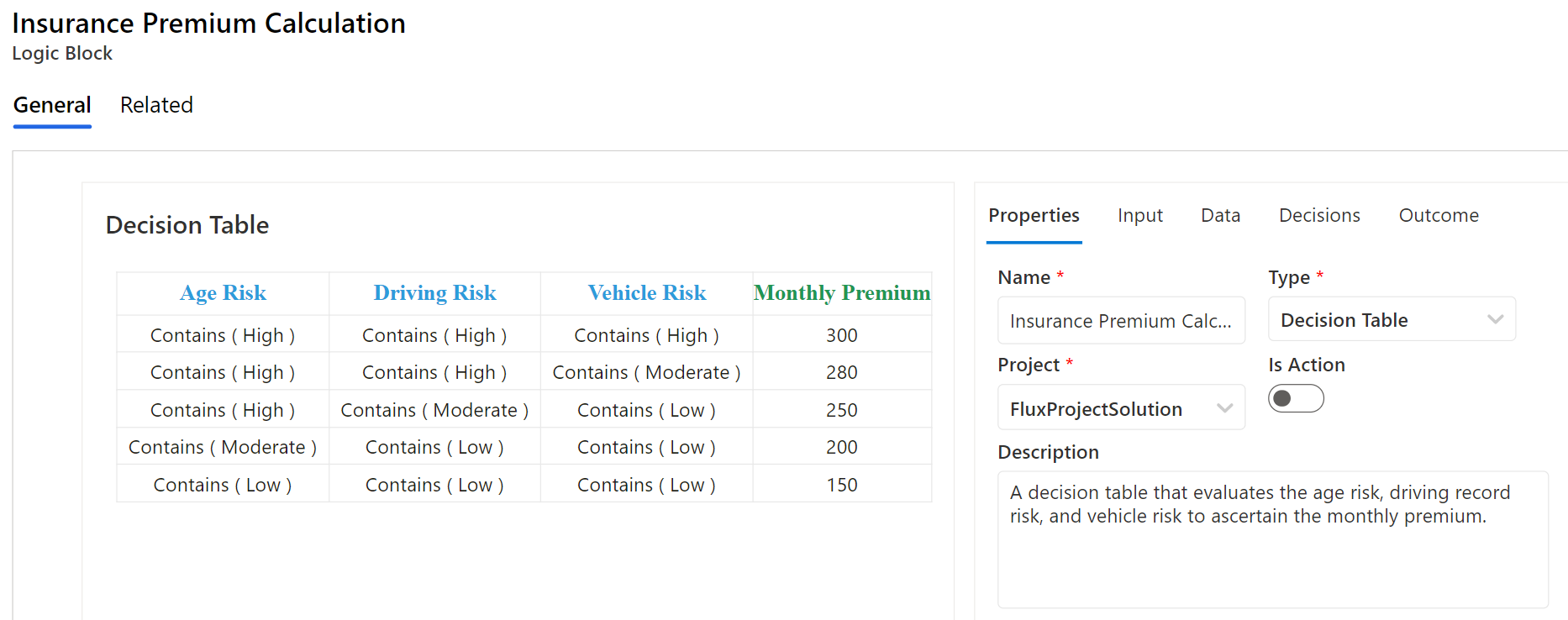

Insurance Premium Calculation:

The insurance premium is primarily determined by combining the risk categories from the driver's age, driving record, and the vehicle risk analysis. Here's a sample decision table:

| Age Risk | Driving Record Risk | Vehicle Risk | Monthly Premium |

|---|---|---|---|

| High | High | High | $300 |

| High | High | Moderate | $280 |

| High | Moderate | Low | $250 |

| Moderate | Low | Low | $200 |

| Low | Low | Low | $150 |

Communicating the Premium Quote

Once the data is processed, the system will provide a premium quote for the client. This ensures clarity and transparency, allowing clients to understand how their risk factors influence their insurance costs.

Solution:

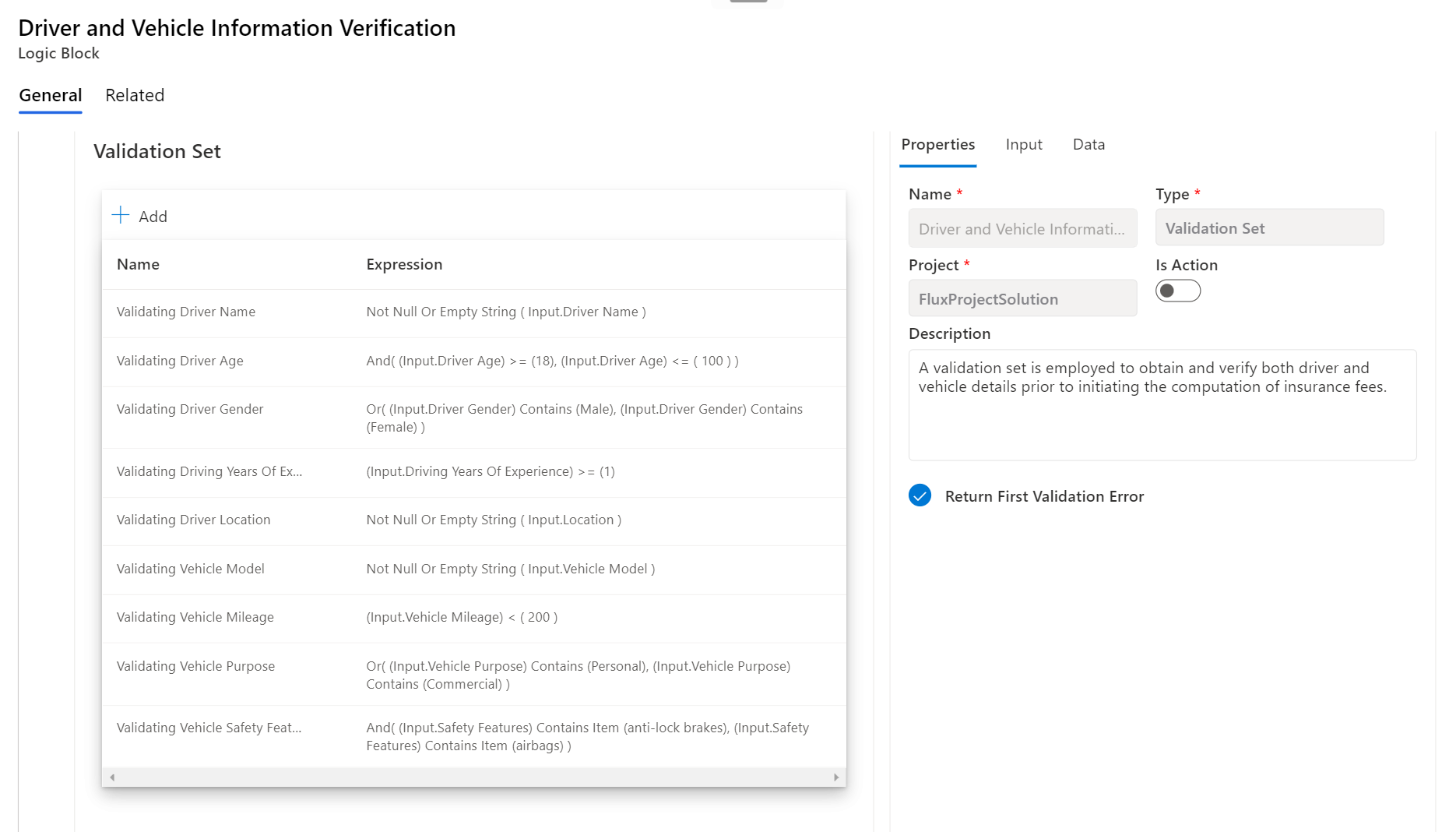

Step 1: Creating a Validation Set to validate the driver and vehicle details.

To initiate our solution, we will be designing a Validation Set. That accept the insurance informations as input.

- Driver's Details: Name, age, gender, driving experience, driving record (number of accidents or traffic violations in the past 5 years), and location.

- Vehicle Details: Make, model, year, mileage (less then 200), purpose (personal or commercial use), and safety features (anti-lock brakes, airbags, etc.).

Each of these inputs is equipped with its own validation block to ensure accuracy and correct format, as shown in the picture below.

And the validation set return an error upon encountering the first inconsistency or inaccuracy. This is to ensure immediate feedback for rectification. With our Validation Set in place, it guarantees that all subsequent steps in the evaluation rely on verified and dependable data.

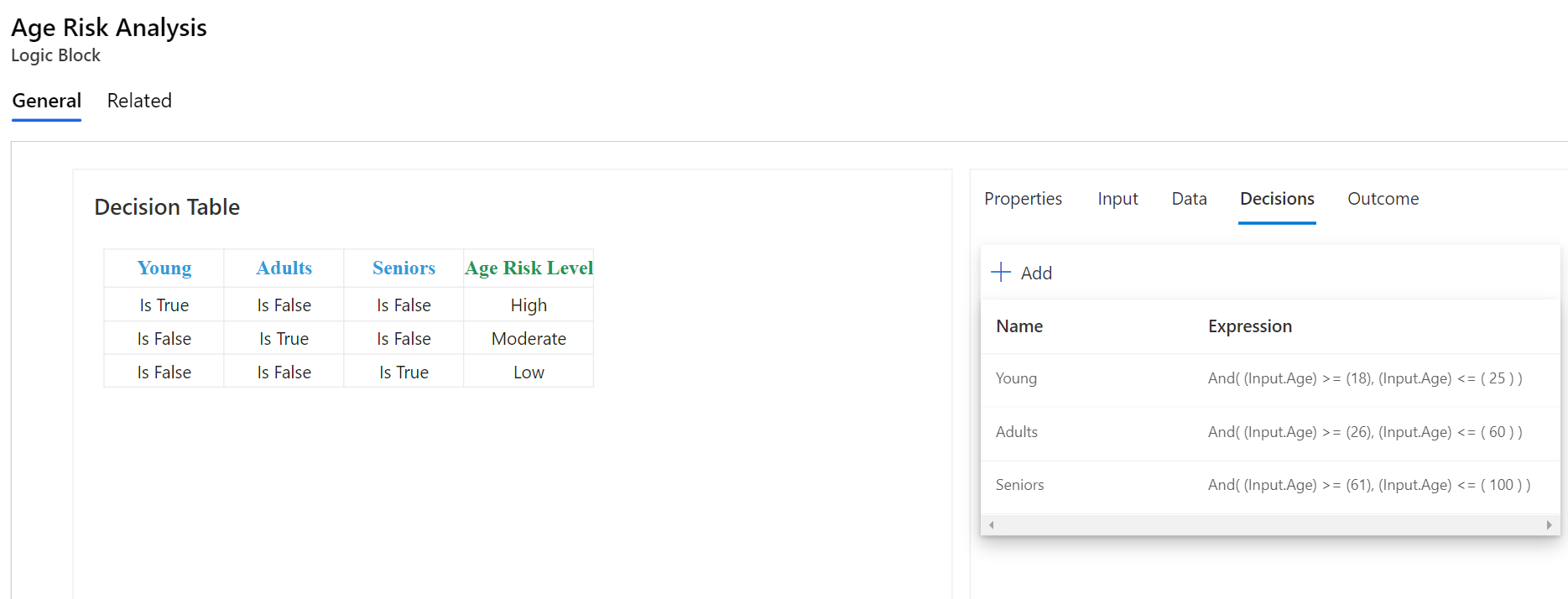

Step 2: Creating a Decision Table to determine the risk based on the driver age

As we progress in our journey to assess the appropriate insurance premium for a driver, a pivotal step is to discern the risk associated with their age. To facilitate this determination, we've crafted a decision table. This table provides a systematic approach to evaluate the risk level based on the age of the driver.

In the above decision table, we can observe the following:

- The "Young" column being marked as true (while the other age categories are false) directly correlates to a high age risk level.

- Similarly, when the "Adults" column is flagged as true (with other age columns being false), it signifies a moderate age risk level.

- Finally, if the "Seniors" column is the only one marked true, the associated age risk level is determined as low. This structured representation aids in swiftly determining the risk based on age, ensuring that the assessment process remains consistent and transparent.

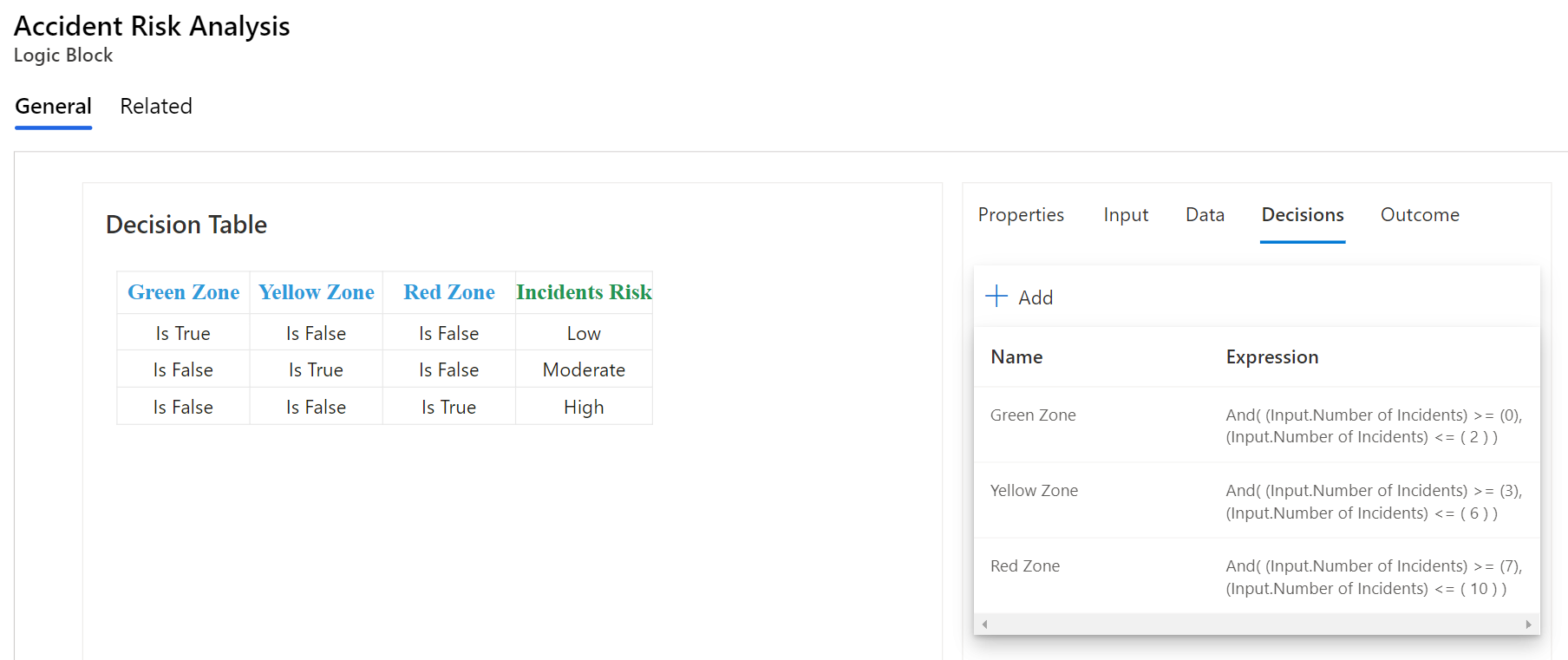

Step 3: Creating a Decision Table to determine the risk based on the accidents record

As we delve deeper into the intricate process of determining the suitable insurance premium for a driver, the third pivotal juncture addresses the influence of a driver's accident history. Recognizing the importance of this factor, we've structured a decision table. This table aims to methodically evaluate the risk level based on the driver's record of accidents.

In the above decision table, we can derive the following insights:

- When the "Green Zone" column is true, and the other incident zones are false, it translates to a low incidents risk.

- Likewise, when the "Yellow Zone" column is marked as true (while the other zones are flagged as false), it indicates a moderate incidents risk.

- And notably, if the "Red Zone" column stands as the singular true flag, the associated incidents risk is discerned as high.

This decision table provides a clear framework for quickly assessing the risk derived from a driver's accident history, reinforcing the consistency and clarity of our evaluation process.

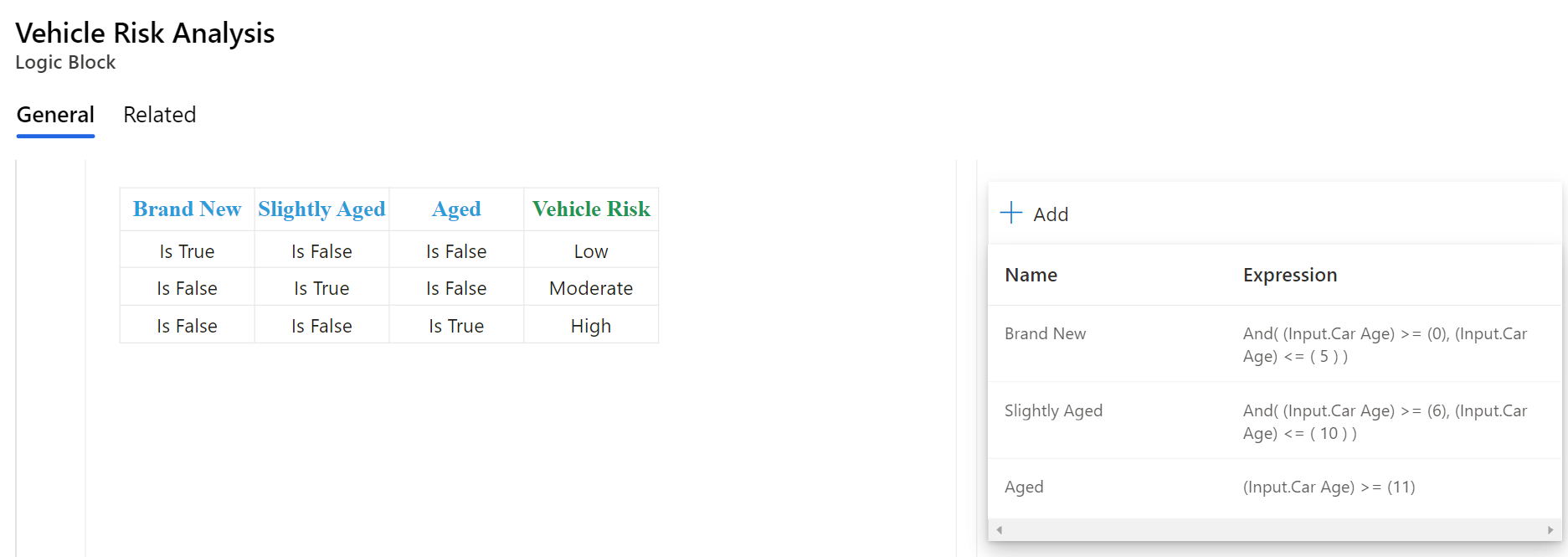

Step 4: Creating a Decision Table to determine the risk based on the vehicle age

As we continue navigating the multifaceted approach to appraising an appropriate insurance premium for drivers, the fourth key aspect highlights the role of a vehicle's age. Given the direct impact of this factor on risk assessment, we've devised a decision table. This table systematically outlines how the age of the vehicle can influence its associated risk level.

In the decision table provided, the following conclusions can be drawn:

- When the "Brand New" column is marked as true and the other vehicle age categories are false, the vehicle risk is gauged as low.

- Conversely, if the "Slightly Aged" column is the only one flagged as true, leaving the other columns as false, it suggests a moderate vehicle risk.

- Finally, when the "Aged" column is the sole column marked true, the vehicle risk is identified as high.

This decision table offers a lucid structure for rapidly assessing the risk influenced by a vehicle's age, ensuring a transparent and uniform evaluation procedure.

Step 5: Creating a Decision Table to calculate the insurance premium based on the age, driver and vehicle risk

Navigating further into our comprehensive insurance premium evaluation process, the fifth stage underscores a holistic approach. Recognizing that a driver's age, their driving history, and the age of their vehicle play pivotal roles in determining premiums, we've constructed a decision table. This table integrates these essential factors, aiming to provide a precise calculation of the insurance premium based on the cumulative risks presented.

Examining the decision table detailed above, we can discern specific patterns and insights:

- Drivers with a "High" age risk, "High" driving record risk, and "High" vehicle risk are poised to have a monthly premium set at $300.

- Those with a "High" age risk, "High" driving record risk, but only a "Moderate" vehicle risk see a slight reduction to $280 for their monthly premium.

- When age risk remains "High," but driving record risk moderates and vehicle risk is "Low," the premium is further adjusted to $250.

- A combination of "Moderate" age risk with both driving record and vehicle risks at "Low" positions the monthly premium at $200.

- Lastly, the lowest premium of $150 is reserved for those with "Low" risks across the board: age, driving record, and vehicle.

This decision table elucidates the gradation in premiums, offering a transparent framework for stakeholders to understand the basis of the insurance costings based on various risk combinations.

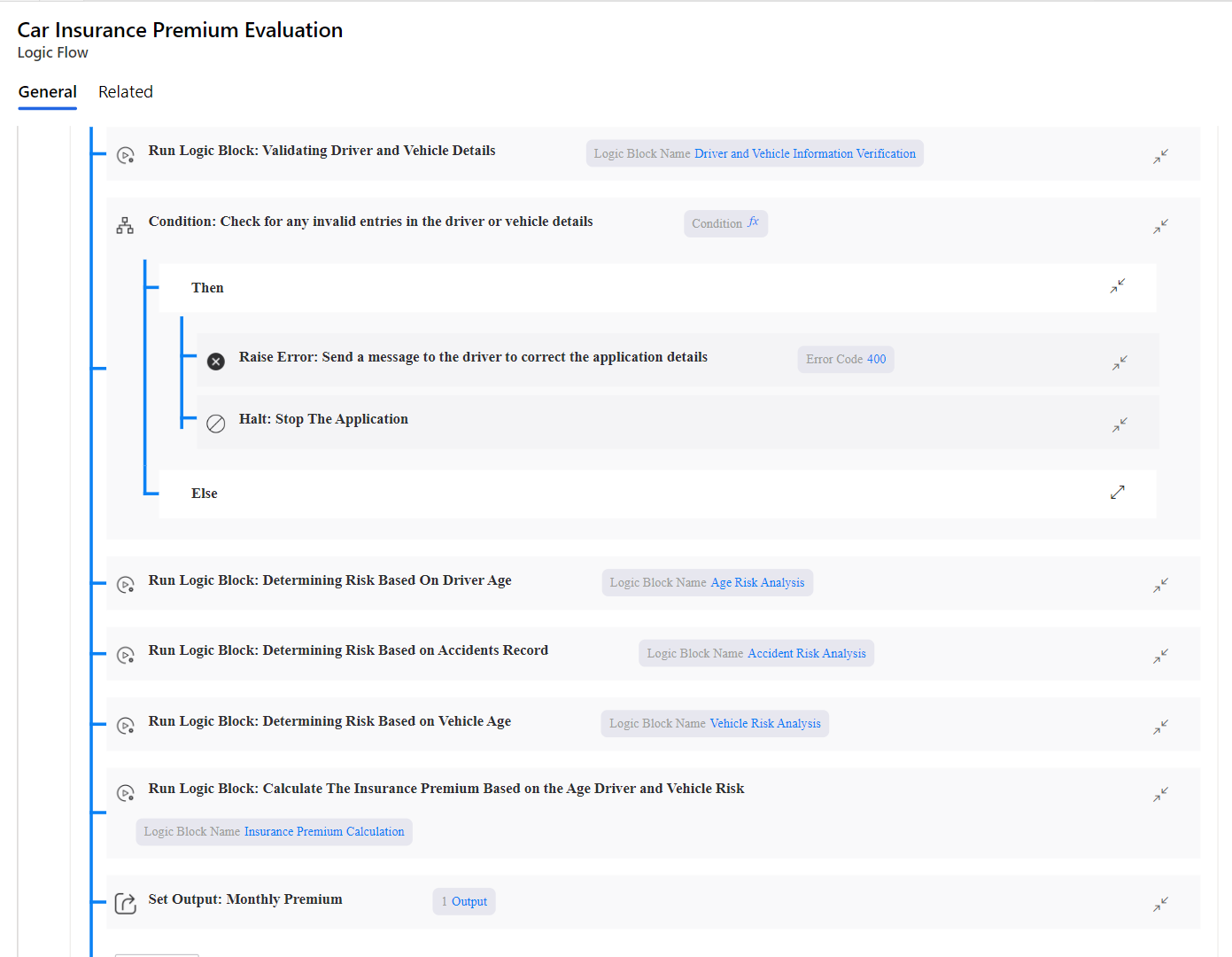

Step 6: Connecting the Dots - Creating The Car Insurance Evaluation Flow

Flows logic function as structured sequences, emphasizing the systematic orchestration of tasks in a designated order. At the heart of this methodology are the individual steps, each pivotal in guiding the process towards the desired outcome. When determining insurance premiums based on driver and vehicle details, each step ensures meticulous data handling and the methodical assessment of risk, resulting in a fair and transparent insurance premium for every driver.

Following the flow in the picture above, here’s the step-by-step breakdown:

Gathering and Validating Insurance Information: The very first step is dedicated to collecting both the driver and vehicle details. These details undergo rigorous validation checks. Any discrepancies trigger an immediate error, ensuring that our foundational data is both accurate and reliable.

Assessing Risk Based on Driver's Age: Given the direct correlation between age and driving risk, the second step uses the designated decision table to categorize the driver into "Young," "Adults," or "Seniors," each carrying a risk rating of high, moderate, or low, respectively.

Analyzing Risk Based on Driver's Accident Record: this step examines the driver's past accident record, classifying them into "Green Zone," "Yellow Zone," or "Red Zone," corresponding to low, moderate, and high risk.

Determining Risk Based on Vehicle Age: The age of a vehicle can have implications for its safety and reliability. Using the established decision table, the system gauges the vehicle's risk based on its age, sorting it into "Brand New," "Slightly Aged," or "Aged" categories, which directly translate to low, moderate, or high risk.

Calculating the Insurance Premium: This is the heart of our logic flow. All the previously assessed risk factors converge here. This step employs the final decision table, which integrates age risk, driving record risk, and vehicle age risk, to meticulously determine the monthly insurance premium. By layering these risks, the system can precisely gauge the holistic risk posed by the driver and their vehicle, translating that into a fair and reflective premium.

Outputting the Final Insurance Quote: With all factors considered and the premium calculated, the system generates a comprehensive insurance quote. This quote not only provides the final monthly premium but also offers a transparent breakdown, showcasing how each risk factor influenced the final amount.

The Car Insurance Evaluation Flow is not merely a sequence of isolated steps. It's a dynamic, interconnected system, ensuring that drivers receive a fair, comprehensive, and transparent insurance quote.

Step-by-Step Video Guide: Navigating the Car Insurance Evaluation Scenario

Welcome to our in-depth video tutorial, designed to guide you seamlessly through the car insurance evaluation journey. Let's break down each step, ensuring you're well-equipped for success